michigan sales tax exemption industrial processing

Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. Students buying meals from University.

Michigan Sales Tax Exemption For Manufacturing

Its important to note that this now applies to employee purchases and not just the exempt entity.

. Industrial processing exemption does not apply to tangible personal property affixed and becoming a structural part of real estate in Michigan A taxpayer selling tangible personal property is required to pay sales tax on retail sales A contractor with tangible personal property that is permanently affixed to and. Manufacturing businesses pursuing a sales tax exemption from Bay City Electric should complete Form 3372 and submit to. SALES AND USE TAX -- INDUSTRIAL PROCESSING RAB-2000 - 4.

Applications are filed reviewed and approved by the local unit of government but are also subject to review at the State level by. This page describes the taxability of manufacturing and machinery in Michigan including machinery raw materials and utilities fuel. Manufacturers and industrial processors with facilities located in Michigan may be eligible for a utility tax exemption.

PPE or safety equipment is eligible for exemption if it meets the following criteria. When property eligible for the exemption is used for exempt and non-exempt purposes the Department is required to. The GSTA and UTA generally define industrial processing as the activity of converting or conditioning tangible personal property by changing the form.

Send a Michigan Sales Tax Certificate to Michigan Gas Utilities Customer Service PO. In order to qualify three requirements need to be met. This tax exemption is authorized by MCL 20554t 1 a.

Sale or Rentals Outside the State of Michigan. Commercial businesses in Michigan are tax-exempt for natural gas used in agricultural production. The industrial processing exemption is limited to specific property and activities.

To learn more see a full list of taxable and tax-exempt items in Michigan. On July 20 2020 the Michigan Department of Treasury released a bulletin allowing PPE to qualify for the industrial processing exemption. Box 19001 Green Bay WI 54307-9001 or fax it to 800-305-9754.

However if provided to the purchaser in electronic. Ad Lookup State Sales Tax Rates By Zip. Michigan Holds that Recycling Machines Qualify for Industrial Processing Exemption.

An Industrial Facilities Exemption IFE certificate entitles the facility to exemption from ad valorem real andor personal property taxes for a term of 1-12 years as determined by the local unit of government. Michigan provides an extensive sales tax exemption for manufacturers involved in industrial processing. Industrial Processing is defined in MCL 2119M as.

PPE or safety equipment purchased by a person eligible for the industrial processing exemption is exempt from Michigan sales and use tax if used or consumed in an exempt industrial processing activity. Download tax rate tables by state or find rates for individual addresses. The department does not issue tax-exempt numbers.

For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act MCL 20552b and Use Tax Act. The Michigan Department of Treasury unsuccessfully argued that the machines may not qualify for. Streamlined Sales and Use Tax Project.

Recently the Michigan Treasury announced that personal protective equipment PPE purchases would be exempt from sales and use tax under an industrial processing exemption. Sales of food intended for immediate consumption including coffee and snack items are subject to sales tax except in the following situations. The Michigan Supreme Court held that sales of bottle and can recycling machines that help retailers comply with Michigans bottle-deposit law may qualify for the states sales and use tax exemption applicable to machinery used in an industrial-processing activity.

Is purchased by the industrial. Sales or Rentals for Industrial Processing or for Resale. The exemption does not include tangible personal property affixed to and becoming a structural part of real estate.

RAB 1988-14 remains in effect for periods prior to March 31 1999. Michigan provides an exemption from sales or use tax on machinery or equipment used in industrial processing and in their repair and maintenance. The State of Michigan allows an industrial processing IP exemption from sales and use tax.

Industrial processing also does not include the receipt or storage of raw materials extracted by the user or consumer or the preparation of food or beverages by a retailer for retail sale. Ad Managed services from Sovos makes your sales tax filings quick easy and painless. Michigan defines industrial processing as the activity of converting or conditioning tangible personal property by changing the form composition quality combination or character of property for ultimate sale at retail or for use in the manufacturing of a product.

Free Unlimited Searches Try Now. The industrial processing exemption is limited to specific property and activities. Personal protective equipment PPE or safety equipment purchased by an individual engaged in industrial processing activity is considered exempt from Michigan sales and use tax so long as the equipment is used in industrial processing activities.

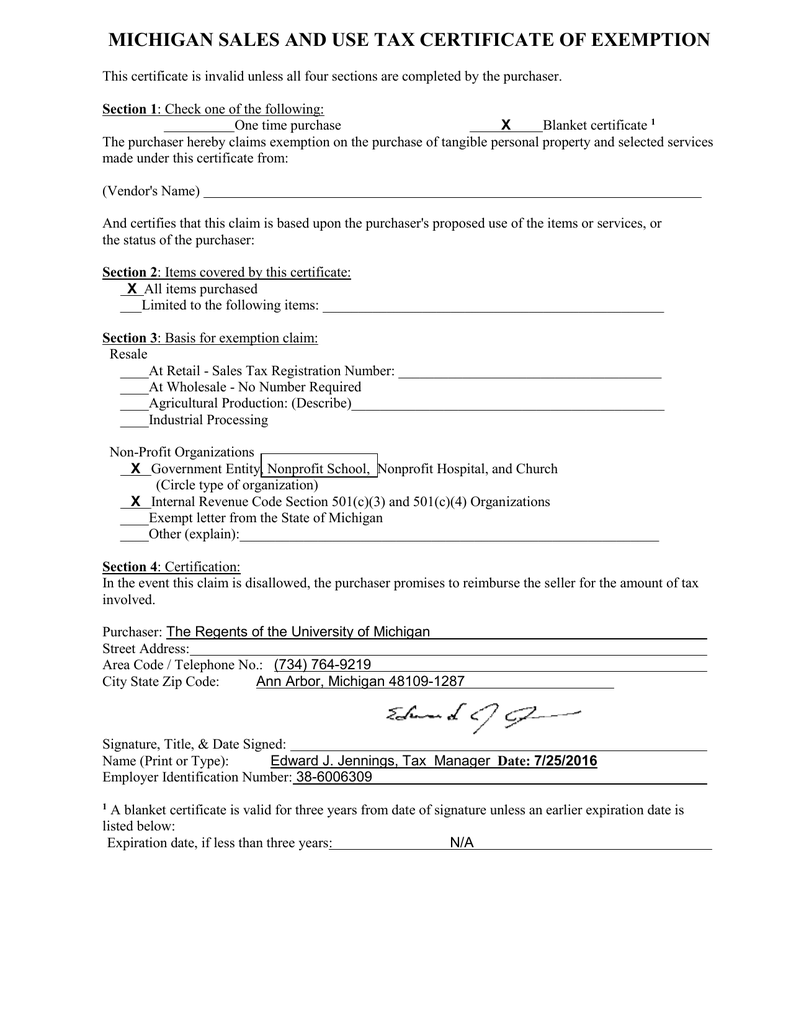

The exemption certificate is 3372 Michigan Sales and Use Tax Certificate of Exemption. Michigan provides an extensive sales tax exemption for manufacturers involved in industrial processing. This Revenue Administrative Bulletin RAB describes the industrial processing exemption allowed under the Sales and Use Tax Acts.

Purchased by an individual whos involved in industrial processing on behalf of an industrial processor or purchased by an individual whos an individual processor. The State of Michigan allows an industrial processing IP exemption from sales and use tax. Michigan offers an exemption from state sales tax on the purchase of electricity natural gas and water used in qualifying production activities.

The General Sales Tax Act defines industrial processing as the activity of converting. PPE or safety equipment is exempt if its. This RAB replaces RAB 1988-14 for periods after March 30 1999.

City of Bay City. Manufacturers and industrial processors with facilities located in Michigan may be eligible for a utility tax exemption. The equipment must be purchased by the industrial processor the equipment is used to protect the safety of the.

All fields must be. The Michigan Department of Treasury DOT had argued that the. They are also exempt from sales tax on the Fixed Charge if they have no use.

The Michigan Supreme Court held that sales of container bottle and can recycling machines and repair parts qualify for the states sales and use tax exemption on machinery used in industrial processing. And Michigan Use Tax Act. Nonprofit Internal Revenue Code Section 501c3 501c4 or 501c19 Exempt Organization.

Ad New State Sales Tax Registration. Michigan Utility Sales Tax Exemption Michigan allows businesses to claim an exemption on the portion of their utility used in industrial processing which includes but is not limited to production or assembly research development engineering re-manufacturing and storage of. Generally exempts property to the extent that it is used or consumed within industrial processing activities.

Sales or Rentals for Agricultural Production. Sale Tax Exemption Michigan information registration support. The industrial processing exemption as authorized by the Michigan General Sales Tax Act.

While Michigans sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Notice of New Sales Tax Requirements for Out-of-State Sellers. Reduce complexity by outsourcing the preparation and filing of sales tax returns to Sovos.

The claimant generally provides an exemption certificate to the supplier of the utility showing the amount that is exempt.

Michigan Sales And Use Tax Certificate Of Exemption

Saas Sales Tax For The Us A Complete Breakdown

Michigan Sales Tax Exemption For Manufacturing

Four Tips And Tricks To Qualify For Manufacturing Sales Tax Exemptions

Michigan Sales Tax Exemption For Manufacturing

Michigan Utility Sales Tax Exemption Utility Study Experts

Michigan Sales Tax Exemption For Manufacturing

Michigan Sales Tax Exemption For Manufacturing

Pin On Business Books Related To Self Improvement Leadership Sales Money And Mindset

Michigan Sales Tax Small Business Guide Truic

Economic Nexus Laws By State Taxconnex

Michigan Sales And Use Tax Audit Guide

Michigan Sales And Use Tax Audit Guide

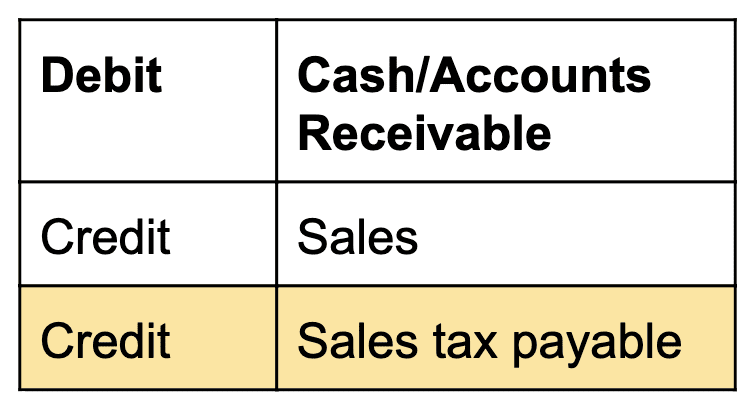

When Is Sales Tax Due On A Lease

Michigan Sales And Use Tax Audit Guide

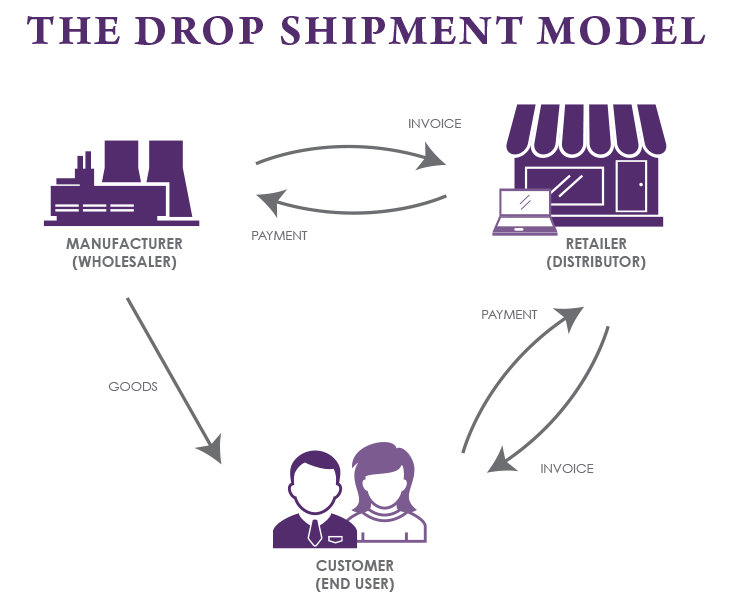

How Do Drop Shipments Work For Sales Tax Purposes Sales Tax Institute

Michigan Sales Tax Guide And Calculator 2022 Taxjar

Michigan Safety Equipment Exempt From Sales And Use Tax Doeren Mayhew Cpas

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors